RiACT - Fund Management Software

RiACT FMS Funds management Software help institutional investors, hedge funds, private equity firms, fund administrators and securities transfer agents improve both investment decision-making and operational efficiency, while managing risk and increasing transparency. RiACT supports all types of funds and investment vehicles, and helps in Purchase, Sales and Valuation of Assets instantly. The comprehensive Queries and Reports allow users to get up to date status of financial and activity accomplished.

Standard Cross Module Features

- Multi User

- Multi Currency

- Multi-Module Integration & Interfaces

- On-line Entry & Modification

- Extensive Input Validation & Verification

- Ease Of Data Entry & Transaction Adjustment

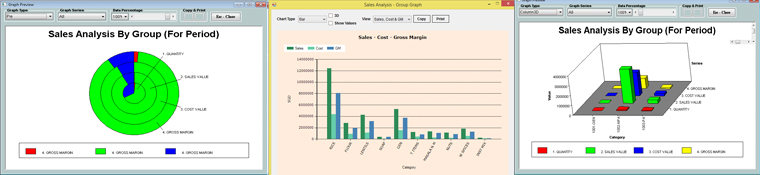

- Comprehensive Reporting & Queries

- History File Maintenance For Strategic Data

- Flexible Configuration

- Security To Prevent Unauthorized Access

The products are architectured to run on popular IBM Compatible PCs either in stand-alone mode or in a LAN environment. It is engineered to provide high performance in demanding environments.

Salient Features & Menu Options

Masters

- Configuration of Company, Accounting Period, Currency, Country, Bank & Transaction Type

- Configuration of Stock Counter, Security Type, Periodicity, Rate Basis, Rating Type

- Configuration of Account Code, Account Group Code, Account Group Link Code

- Configuration of Security Group Acct Code, Security Bank Code

- Creation of Transaction Detail Template

- Configuration of Invoice Numbering, Specification, Third Party, Account Code Mapping, Account Code for Posting, Bond report Type Update, Current Processing Period

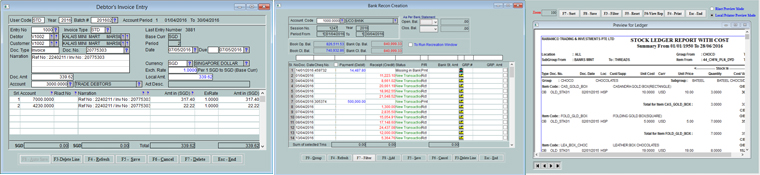

- Separate Transaction screens for Bond Purchase, Sales, Coupon Receipt and Master Entry

Transactions

- Transaction screens for Equity Purchase, Sale, Dividend Receipt Entry

- Deposit Entry, Interest Receipt Entry and Deposit Maturity Entry

- Loan Entry, Loan Maturity & Interest Entry and Interest Payment Entry

- Entry screens for F.C Entry, Currency Option, OTC Option & Stock Option Entry

- Record Payments, Receipts, Journals through separate transaction Screens.

- Comprehensive BRS from Setup, Initial Entry, Recon Creation, Reconciliation, Listing, Statement and Reversal.

Query

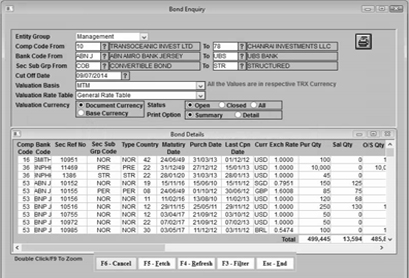

- Detailed Enquiry Screens for Bond, Equity, Deposit & Loan

- Enquiry Screens for FC, SO, CO, OTC

- Enquiry based on Voucher Number, Security Ref No, Sub Code, Deposit Roll Over Trace & Loan Roll Over Trace Enquiry.

Reports

- Interest Calendar & Multi-currency Ledger

- Reports include various Trial Balance Reports, General Ledger Reports, Profit & Loss Statement and Balance Sheet Printing

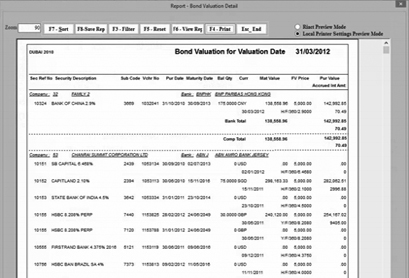

- For Bonds, Holding Analysis, Duration Report and Return Reports are available in the System.

- For Deposits, Loans & Equity, Holding Reports can be generated.

- Statements for Cash flow & Asset Allocation are key reports available in the system.

Valuation

- Daily Exchange Rate, Contract Option Size, Bond Valuation, Equity Valuation

- FC, SO & OTC Rate, CO Tick Rate

- Bond, Equity, Deposit & Loan Valuation

- SO, CO, OTC, FC & Exchange Valuation

- Bond & Equity Profit Valuation Reports

- Account Balance Recreation, Period End Processing, Recalculation of Balances

- Year End Posting By Company, Year and Period Correction

- Bond Balance Recon, Equity Balance Recon

Administration

- Module Control

- Auto Numbering

|

|

|

|